Decentralized Finance (DeFi) Development

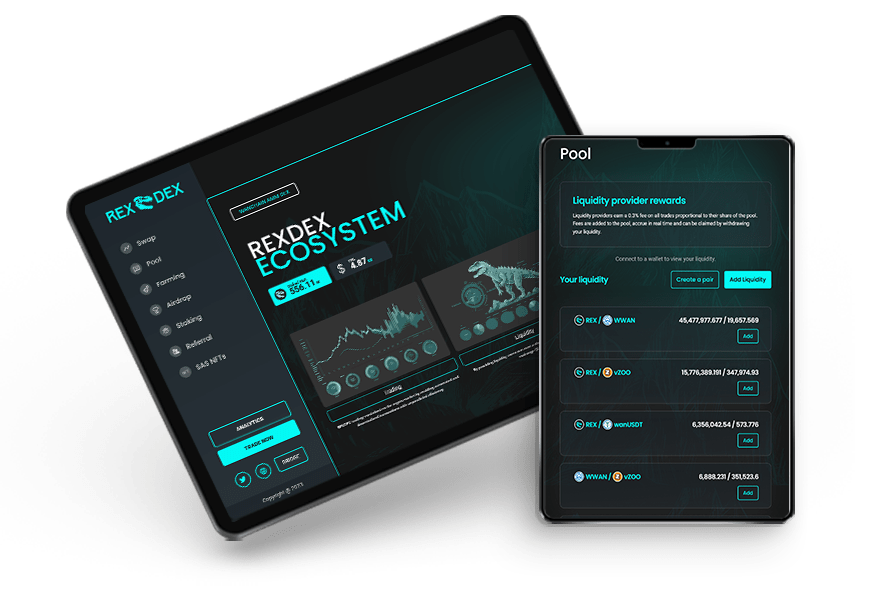

Decentralized Exchange (DEX) Development, Lending and Borrowing Platforms, Yield Farming and Staking, DeFi Derivatives

Transforming Finance with Decentralized Solutions

At Avolox, we specialize in Decentralized Finance (DeFi) development, enabling businesses to tap into the rapidly growing world of decentralized finance. DeFi is revolutionizing traditional financial systems by providing transparent, secure, and permissionless financial services on blockchain networks like Ethereum, Solana, and Binance Smart Chain.

As of 2024, the total value locked (TVL) in DeFi protocols is estimated to be around $50 billion, showcasing remarkable growth from just $1 billion in 2020. Analysts predict that the DeFi market could grow to over $800 billion by 2030, as more users and institutions adopt decentralized financial services.

Whether you're looking to build decentralized exchanges (DEXs), lending platforms, or yield farming protocols, our expertise in DeFi development can help you create innovative solutions that empower users and disrupt conventional financial models.

Why Choose DeFi?

DeFi represents the future of finance, offering several key advantages over traditional financial systems

Decentralization

DeFi platforms operate without central authorities, giving users full control over their assets and transactions. Learn More

Transparency

Every transaction on a DeFi platform is recorded on a public blockchain, ensuring transparency and trust. Learn More

Accessibility

DeFi services are accessible to anyone with an internet connection, eliminating barriers to entry and providing financial services to the unbanked.

Our DeFi Development Services

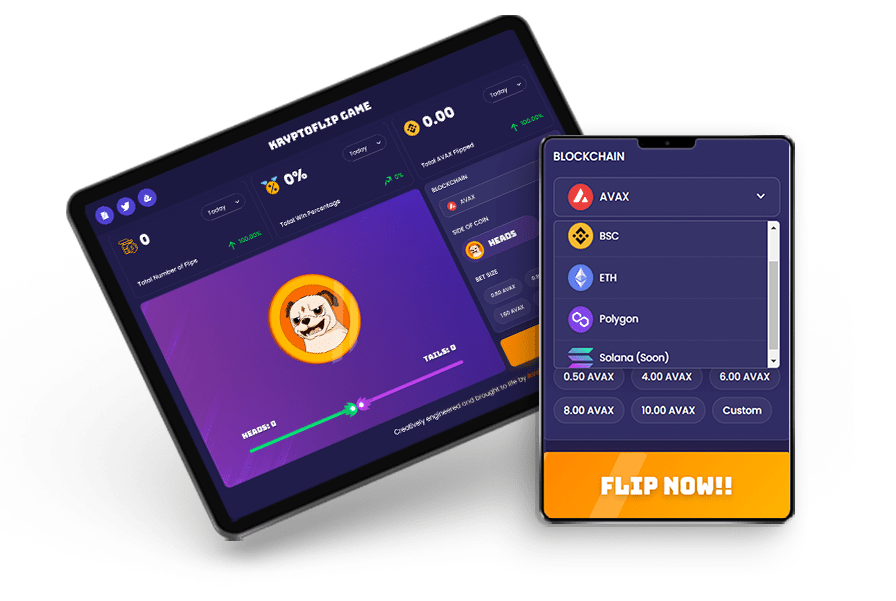

Create secure and efficient platforms for trading digital assets without intermediaries:

-

Automated Market Makers (AMMs):

Develop AMMs that facilitate liquidity pools and enable users to trade assets directly from their wallets. Learn More -

Order Book DEXs:

Build decentralized exchanges that use order books to match buy and sell orders, providing a more familiar trading experience. -

Cross-Chain DEXs:

Enable trading of assets across different blockchains by building cross-chain decentralized exchanges, leveraging interoperability protocols.

Empower users with decentralized lending and borrowing services that offer transparency and control:

-

Collateralized Lending:

Create platforms where users can lend assets by collateralizing cryptocurrencies, enabling secure and trustless lending and borrowing. Learn More -

Flash Loans:

Develop innovative flash loan services that allow users to borrow and repay assets within a single transaction without the need for collateral. Learn More -

Interest Rate Models:

Implement dynamic interest rate models that adjust based on supply and demand, optimizing returns for lenders and affordability for borrowers.

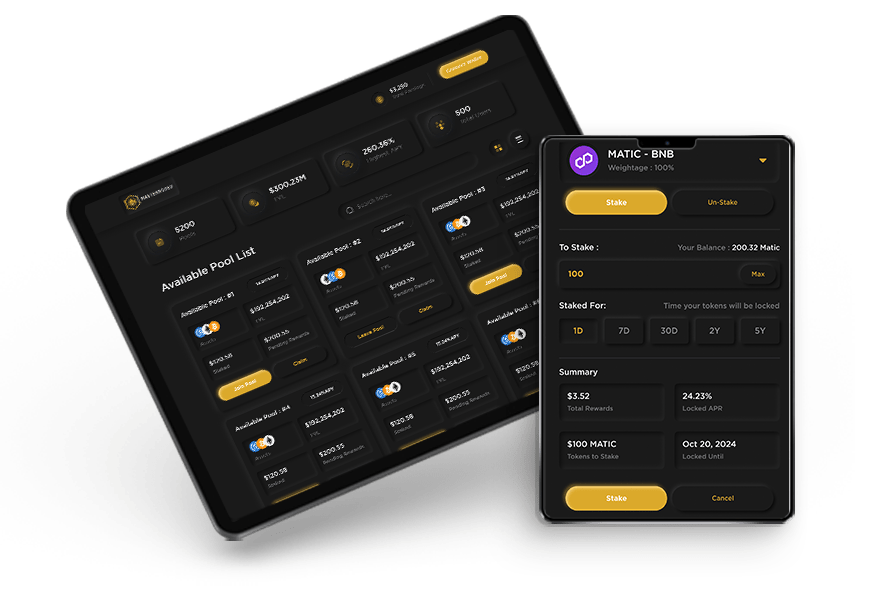

Maximize user engagement and participation through yield farming and staking protocols:

-

Yield Farming Protocols:

Develop yield farming platforms that incentivize users to provide liquidity to DeFi protocols in exchange for rewards. -

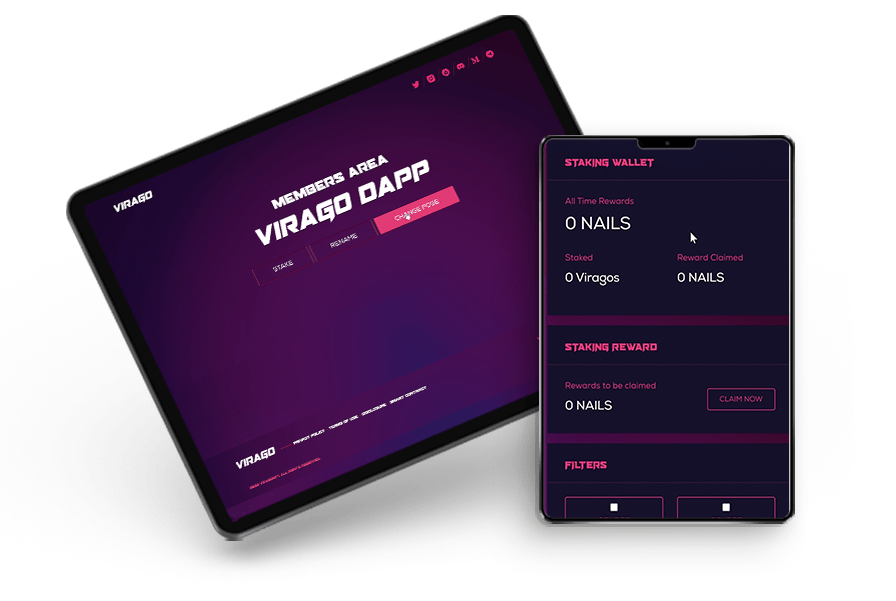

Staking Platforms:

Build staking mechanisms that allow users to earn rewards by locking up their assets to support network security and governance. Learn More -

Liquidity Mining:

Implement liquidity mining programs that reward users for contributing to the liquidity of your DeFi platform.

Tap into the growing market of decentralized derivatives:

-

Synthetic Assets:

Create synthetic assets that track the value of real-world assets, allowing users to gain exposure to commodities, stocks, and more without owning them. Learn More -

Options and Futures:

Develop platforms for trading options and futures contracts on a decentralized basis, providing users with advanced financial instruments.

Real-World Use Cases in DeFi

DeFi is already transforming finance with real-world applications

Peer-to-Peer Lending

Enable users to lend and borrow assets directly with each other, eliminating the need for traditional financial intermediaries.

Decentralized Savings Accounts

Create savings platforms that offer interest rates higher than traditional banks by leveraging DeFi protocols.

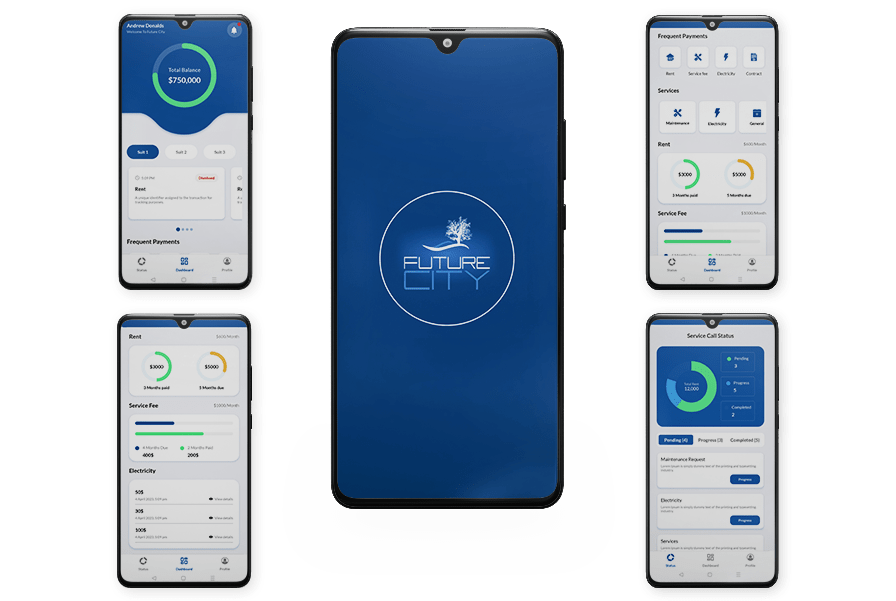

Tokenized Real Estate

Allow users to invest in fractional ownership of real estate through tokenized assets on a DeFi platform.

Insurance on the Blockchain

Build decentralized insurance platforms where users can pool funds and receive payouts based on predefined smart contract conditions.

Why Choose Avolox for Defi Development?

-

Defi Expertise:

Our team has deep experience in building and deploying DeFi protocols across various blockchain networks, including Ethereum, Solana, and Binance Smart Chain. -

Security Focus:

We prioritize security at every stage of development, from smart contract audits to implementing robust security measures to protect user assets. -

Comprehensive Services:

We offer end-to-end DeFi development services, from initial consultation and strategy to development, deployment, and ongoing support.

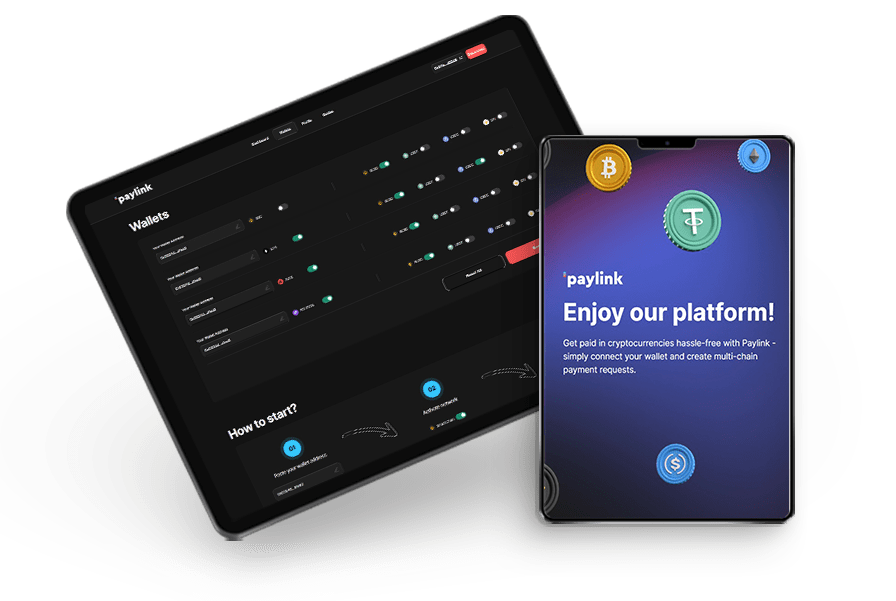

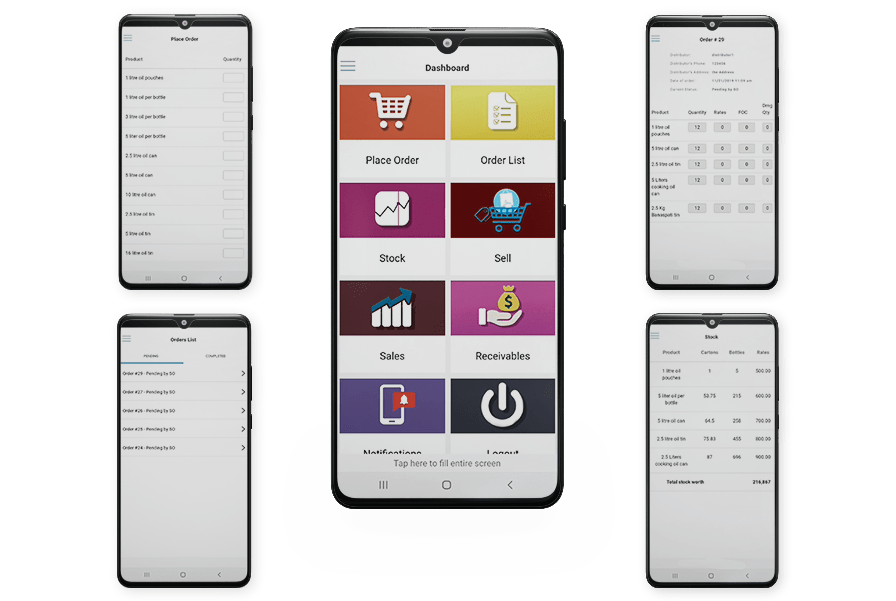

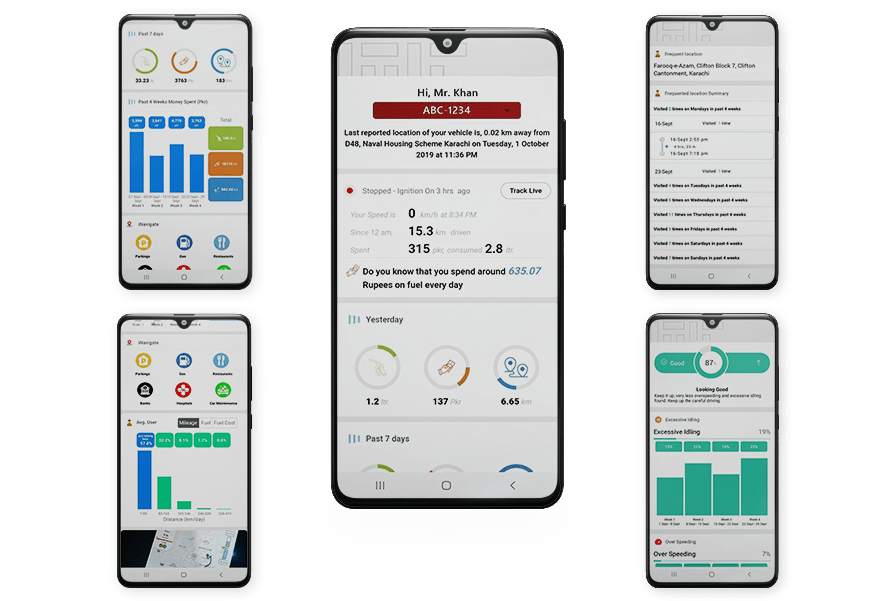

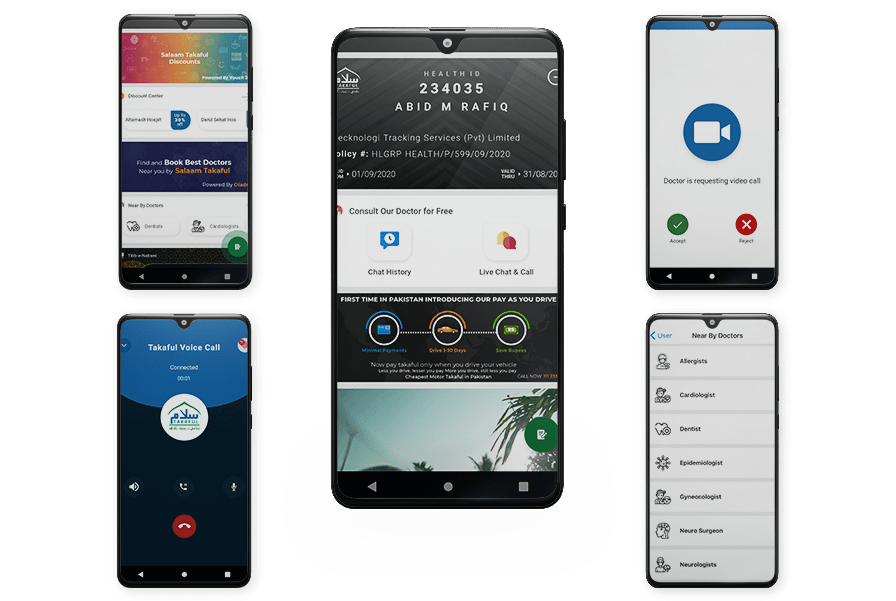

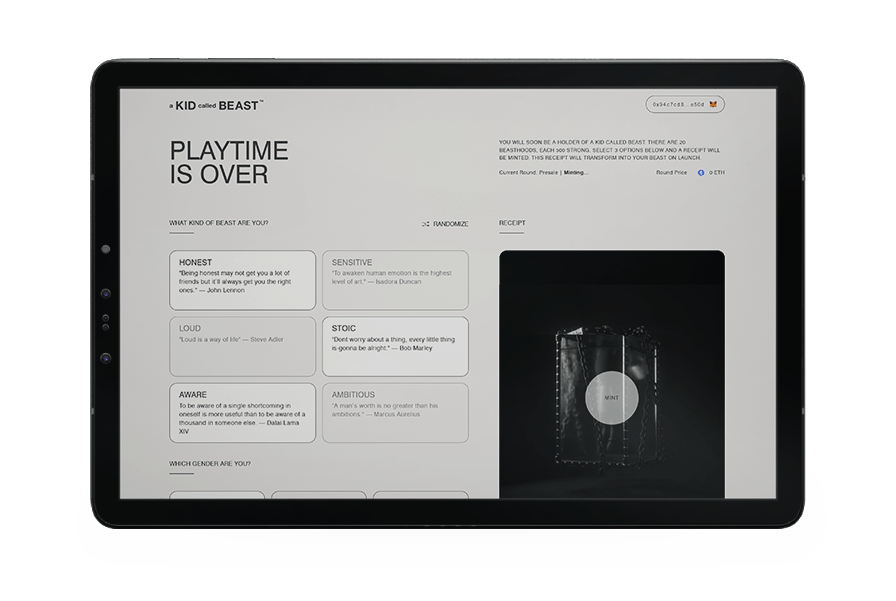

Case Studies

Contact us

Our offices

-

.

United States

600 S TYLER ST, SUITE 2100 #182

AMARILLO, TX 79101 -

.

United Arab Emirates

A hub of remote jobs